In my decades in D.C., I interviewed members of Congress daily as a reporter, met with staff and occasionally members as a lobbyist, and dug deep into policy as an analyst. As a citizen in Oregon, I do all three. When I started lobbying the legislature five summers ago, I compared the two venues to major and minor league baseball. The minors are more fun: beer is cheaper, seats closer, players less polished. An Oregon legislative session is about the length of a baseball season, and its rhythm is similar. There’s practice (reading and writing), and there’s performing (testifying and lobbying). On the last Sunday in June, it finally ended.

It is hyperbole for an interest group to claim it achieved a particular outcome. Many ingredients go into Salem Sausage over a six-month session. For my cadre of volunteers, Tax Fairness Oregon, I testified 20 times before committees and had scores of meetings with legislators and staff. TFO’s often-lonely critiques of bad bills (how we spent most of our time) perhaps gave a committee chair the backbone to say no to colleagues. I drove one bill from its introduction to the governor and watched helplessly as another bill I’d carried died.

TFO had four priorities in January, two of them concerning subsidies for business. One was to minimize the resurrection of a research and development tax credit; the other involved reforming the authority the legislature grants localities to reduce business property taxes in exchange for, you know, making money. For the other two priorities, the strategies were mine to devise and execute: “disconnect” from the 2017 federal Opportunity Zones provision, which gives investors and landowners tax benefits; and eliminate the tax credit auctions that fund a slice of Opportunity Grants for low-income college students.

How’d we do?

The business lobby promoted the R&D credit as critical to Oregon’s effort to attract semiconductor companies and to the national effort to rebuild domestic manufacturing. Never mind that legislators rushed through $210 million to persuade the Biden administration that it deserved a piece of the pie being dispensed to build chips. Also: Ignore administration guidance warning states that handouts to companies would not boost their applications for federal subsidies.

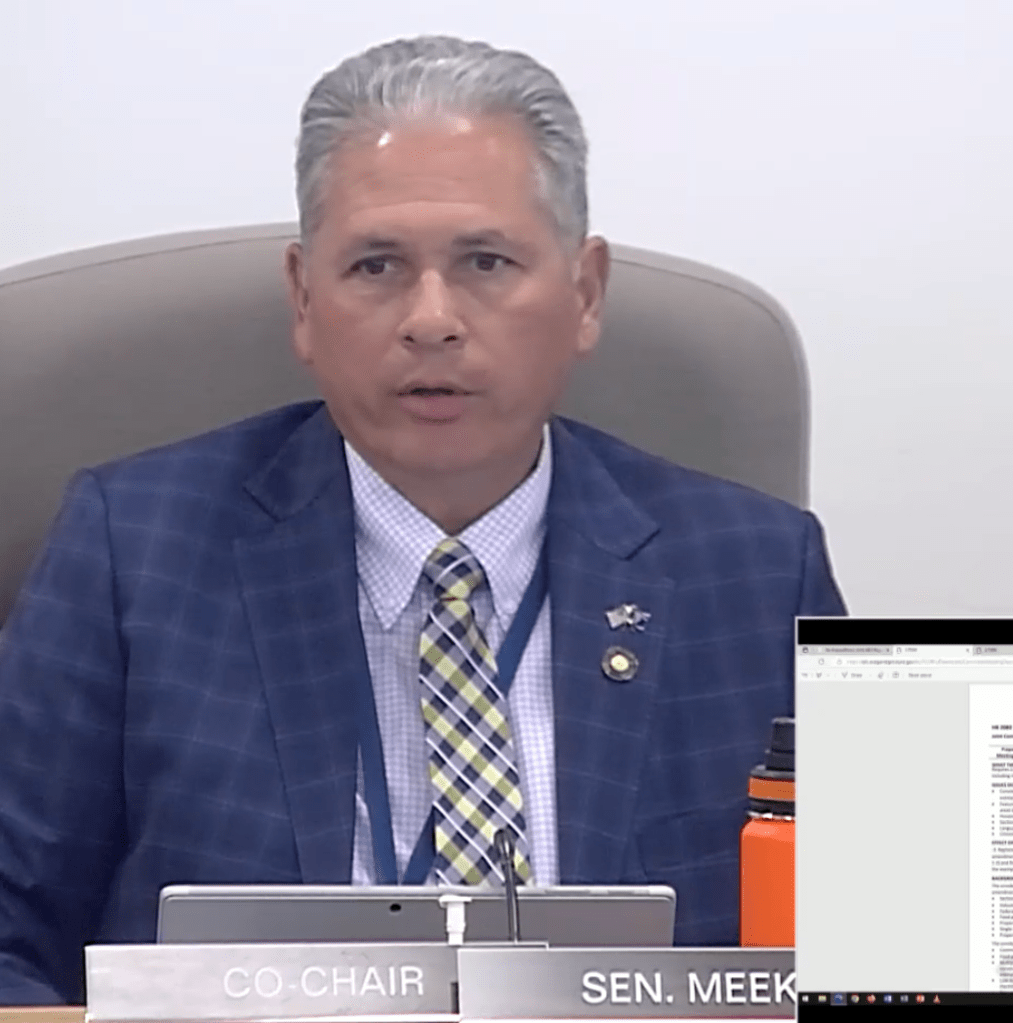

Early in the session, a former legislator who works with us, Phil Barnhart, told Senate Finance Committee Chair Mark Meek why the R&D credit had been allowed to sunset six years ago (it made no difference to the businesses that took it). I followed Barnhart, testifying to its ineffectiveness at the state and federal level. Demonstrating that TFO has no vote, the next day Meek championed a robust R&D in another committee stacked with industry supporters. It was an indication of how the session would go, as Meek, a freshman Democrat and the only challenger to unseat an incumbent in either chamber, smiled a lot while promoting Republican priorities.

After debate that ran through four committees until the last week of the session, the R&D credit, in HB 2009, is modest, and it will be available only for semiconductor research. Intel, the state’s biggest private employer, will spend on research whatever it would have spent on research. The provision is a waste, but considering the drumbeat to give away more, it could have been worse.

The Oregonian spent the past year documenting abuses of the Enterprise Zones program: secret deals between county governments and corporate beneficiaries and the absurdity of giving tax breaks for Amazon and UPS warehouses (which must be near their customers) and tech data-storage centers (which take advantage of cheap Columbia River power and water). Because of Oregon’s system of equalizing school funding across the state, rural counties can give away property tax revenue to businesses for up to 15 years, and the state school fund reimburses them. The localities are made whole, while the leak in statewide funding drains K-12 elsewhere. The education unions brought political heft to our critique, even as many lawmakers backed their counties and the businesses that suck at the government teat.

House Revenue Chair Nancy Nathanson and committee Republican Greg Smith devised reforms, many of them on lines we had proposed. One would have slashed a subsidy that goes almost entirely to wealthy Washington County to compensate it for huge tax breaks it gives to Intel, Nike and other big employers. The county reps in Salem defended it like Patrick Henry defended liberty; the payments survived unchanged.

All those issues were wrapped in one bill, bound for the governor. It eliminates some tax breaks and requires some of businesses to make up for taxes with fees for K-12. It requires measured public disclosure of pending tax abatements. Overall, it resolved a vociferous debate for another eight years.

My bitter loss was the legislature’s failure, as in 2020, to “disconnect” from Opportunity Zones. I had spent five months meeting with nearly every Democrat in the House and most in the Senate to gather support. I had talked with local officials and developers, gathering evidence that O Zones failed to do what supporters promised: create economic benefit in poor areas in return for tax benefits to rich investors. I testified on HB 3039 and went head to head with the business lobby, while allies from 2020 were mostly engaged elsewhere. I was giddy when the disconnect—effectively requiring investors to pay taxes on O Zone profits just like any other capital gains—was written into HB 2009 as introduced by Nathanson and Speaker Dan Rayfield. Their intention was that the investor class pony up a little for all the generosity otherwise bestowed. But in the backroom with Nathanson, Meek said no.

I had erred: I relied on earlier conversations with Meek. A real estate agent, he had opposed my bill in 2020, when he was in the House. This time he had told me he understood the federal provision was a waste. I was so focused on the House that I assumed Speaker Rayfield’s support would carry the day. Meek changed his mind.

Speaking of the rich, Meek held a half-dozen hearings on bills to reduce the estate tax. The worst of them was SB 498, which in its original version would open a loophole for hobby farmers—people who diversify their portfolios with “natural resource property” (a tax carveout for small farms, fisheries and timberlands)—to exclude part of their holdings from the estate tax. I testified twice as the bill went through multiple permutations. Meek worked with Republicans, settling on one that allows billionaires to exclude up to $15 million from the estate tax.

Pause here to note: On May 3 Senate Republicans had walked out of the session, protesting two bills that had passed the House, one dealing with abortion and transgender rights, the other gun control. Because the House and Senate require a two-thirds quorum to do business, and Republicans control more than a third, and the session constitutionally may last no longer than 160 consecutive days, the minority can run out the clock. It has used that leverage to force the majority to abandon bills for five consecutive sessions. But last fall, Oregon voters, by 68%, passed an initiative intended to curtail the weapon: It bars legislators from running for reeelection if they have 10 “unexcused” absences. Eleven of 13 Republican senators are so barred because of their walkout this year.

The two-thirds quorum does not apply to committees, which continued to meet with simple majorities. Often the two Republicans on the five-member Finance Committee continued to show, and Meek accommodated them. After six weeks, Senate Democrats cut a deal to get Republicans back on the floor. Among the rumored concessions: a vote on the estate tax bill.

When The Oregonian reported on the deal, it named the estate tax bill as an element—and misstated current law and SB 498. I emailed the reporter, warning him against buying the GOP’s unexamined claim that it would save family farms—which are protected under a 2007 law TFO helped fashion. A second story again got the facts wrong. With my colleagues, I spent a day in Salem during the final fortnight lobbying against the bill, with some effect. SB 498A split the Democratic caucuses: 9 of 17 senators and 20 of 34 representatives present—including Nathanson—voted against it on the floors. I drafted a memo to the governor asking her to veto it and rounded up more powerful opponents; the bill awaits her decision.

We had one unalloyed victory that would not have happened had I not identified it: a provision by which the state sells $14 million a year in tax credits, the proceeds of which fund Opportunity Grants, patterned after federal Pell Grants. I asked the Department of Revenue, which runs the annual auctions: who bought them? DOR interpreted the records as confidential taxpayer information. I asked for a second opinion; the attorney general agreed with me. The auctions have cost students $3.8 million in grants over the past four years, the money instead going to in-the-know taxpayers who bought the tax credits. It made no sense for the state to use a wasteful financing mechanism rather than appropriate all the money out of the budget like any other program.

Under current law, another round of auctions was scheduled for December. I sought amendment to a routine bill, SB 129, to end the auctions immediately, instead of extending them another six years. Over months, I reminded leaders of the budget-writing Ways and Means Committee to increase funding to make up for the auctions. (It did, from $200 million to $300 million).

The amended bill unanimously passed two committees, in March and June. In the final week, the Senate approved it 25-0, the House 45-7. The seven nays came from Republicans. Perhaps US Bank whispered in their ears: it had profited $1.29 million over two years by buying tax credits.

Committees heard dozens of other bills on which we spoke. Most of the time we said: This is dumb, and it died or was amended. Occasionally we said: Sounds okay, and it passed. Sometimes we said: This is outrageous, and it was sent to the governor. But our points were acknowledged.

As when I opposed motherhood and apple pie in a Senate Finance hearing on SB 540. The bill would exempt $17,500 in military pensions from income tax for individuals younger than 63. Advocates said the bill, which would cut taxes by up to $1700 ($17,500 multiplied by the top marginal income tax rate), would spur new retirees with in-demand skills to move to Oregon. I testified: For those already living here, isn’t it just a gift? Who’s going to disrupt their family and move to Oregon for an obscure tax benefit worth maybe $1700? What revenue would then pay for the services those residents require?

It’s dangerous to cross words with patriots. Upon finishing our testimony, Chair Meek contended that a room full of veterans “would be very insulted by what you just said.” I chuckled, familiar with being a witness hostile to the gravy train.

Meek’s committee sat on the bill for three months, then as a performative gesture passed it three days before sine die. The next day, I wrote the Ways and Means Committee, which had just appropriated $220,000 to study veterans retirement taxation: Shouldn’t the left hand know what the right hand is doing? Meek’s gift to veterans died.

Bennett—I am really proud of you and the work you are doing. Thank you for sharing these insights. It’s a cause you have taken up that is noble and profoundly important. Thank you for fighting the good fight. Seeing even greater success next session (although I know you’ll hardly be kicking back in the meantime, except, perhaps to trek out on your bike?$

Sending love to you and Laurie,

Linda

LikeLike

Bennett,

Thanks for this summary and for all the hours you have spent in combat with the Legislature. Hope you keep it up.

Best, Elsa

>

LikeLiked by 1 person

Great piece! Good title.

Phil

LikeLiked by 1 person

Bennett, you continue to do the Lord’s work. Please keep it up.

-k

LikeLiked by 1 person

Thank you Bennett! It is so refreshing to read your work – your searches for the truth, your understanding of the subject matter, the context you are able to and do provide, the heart. As hard as the losses are, you educate widely and, I believe, effectively. More than one legislator will have an epiphany or ask better questions in the future.

It is unfortunate that Oregon has such a monumentally illogical and inefficient system of government and taxation. Lobbyist nirvana but beggared schools and public health and child, disabled and elderly services. Kudos to you and everyone at Tax Fairness Oregon for continuing to joust at the windmills.

LikeLiked by 1 person

Bennett,

You are fighting the good fight!

Our little local civic group is on the way to a major win. We have been publicly blasting our Planning and Zoning Staff, who are more or less permanent, and our County Commissioners, who serve four years and may or may not be reelected. We are turning the corner from developer pushed growth to County led sustainable development. For example, greenspace in conservation developments has doubled to 25% and 50%, depending on the development; most developments must be 0.5 to 1 acre lot minimum; higher density apartments must be approved only in certain pockets on major roads and near our only incorporated city; and more. We made enough noise that we were invited to participate in writing the current round of Land Use Plan and Map; lot sizes and setbacks by zone; and United Development Ordinance. Staff has submitted an overhaul to the Commission for consideration and action in August or September. It’ll pass 5-0 or 4-1.

Keep up the good work!

Best,

George

LikeLiked by 1 person

George, the more local the politics, the greater anyone can affect the process (see all those book banners). Fewer players, more intimate contact. For Congress, unless you bring a check for $25,000, no one cares.

LikeLike